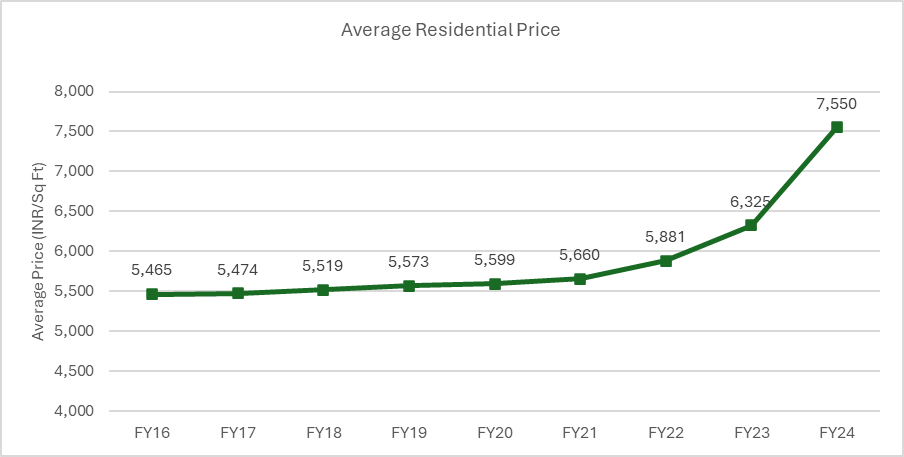

- Avg. property values in the top -7 cities have appreciated at a CAGR of 13% in the last 2 financial years.

- CPI inflation moderated by 1.3% on an annual average basis to 5.4% at the end of FY24.

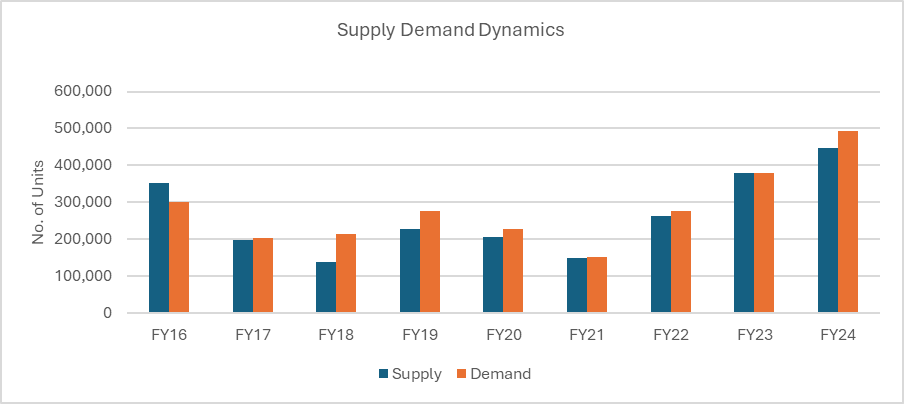

- 8.25 lakh new homes launched & 8.72 lakh units sold during last 2 financial years

Inflation, the gradual increase in the general prices of goods and services, erodes the purchasing power of money over time. For investors seeking to preserve and grow their wealth amidst inflationary pressures, real estate has emerged as a popular hedge against this dreaded but inevitable dynamic, finds ANAROCK research.

Price growth over the last three elections

Shobhit Agarwal, MD & CEO – ANAROCK Capital, says, “After the 2019 elections, average residential prices across the top 7 cities have appreciated at a Compound Annual Growth Rate (CAGR) of 6% – rising from INR 5,600/sq.ft. in June 2019 to INR 7,550/sq.ft by the end of FY 2024. A similar trend was witnessed in relation to the 2014 elections. Average prices across the top 7 cities saw an annual rise of over 6% in 2014 when compared to the preceding year – from INR 4,895/sq.ft in 2013 to INR 5,168/sq.ft in 2014.”

Conversely, before the 2019 elections, average prices rose by a mere 1% annually, and remained rangebound during the tenure.

Source : ANAROCK Research, Data for Top 7 cities

Supply – Demand Dynamics

In the last decade, there were periods when the supply of real estate exceeded demand, resulting in stable price growth that kept pace with inflation in the pre-pandemic era. Between 2013-2020, the top 7 cities recorded a cumulative supply of 23.55 lakh units against a demand for 20.68 lakh units.

Gradually, demand rose in tandem with new supply. Available inventory peaked at approx. 8 lakh units by the end of 2016. However, following the pandemic, residential real estate saw rapid recover, leading to significant price growth that has outpaced general inflation.

Source: ANAROCK Research, Data for Top 7 cities

Real estate – a hedge against inflation

Inflation, the gradual increase in the general prices of goods and services, erodes the purchasing power of money over time. For investors seeking to preserve and grow their wealth amidst inflationary pressures, real estate has emerged as a popular hedge against this dreaded but inevitable dynamic.

Steady population growth coupled with urbanization consistently fuels housing demand. As more people migrate to cities for better opportunities, rising residential demand exerts upward pressure on prices.

Moreover, real estate investments can generate rental income, which potentially grows over time in response to inflation. As the cost of living rises, landlords typically adjust rental rates. Also, investors can leverage their real estate assets to borrow funds for further real estate acquisitions.

During inflationary periods, the cost of borrowing (interest rates) typically rises. However, investors who have secured fixed-rate financing before inflationary pressures set in can benefit from lower borrowing costs in real terms, enhancing the profitability of real estate investments.

“Real estate investments offer diversification benefits within a portfolio,” says Agarwal. “Unlike financial assets such as stocks and bonds, which may be negatively impacted by inflationary pressures, real estate – including residential, commercial, and retail – provides a tangible asset with intrinsic value. Diversifying investment portfolios with real estate holdings can mitigate overall portfolio risk and enhance long-term returns.”

Residential real estate prices have risen continuously since 2013, and in the last two years, appreciated at a CAGR of 13% while CPI inflation moderated by 1.3% on an annual average basis to 5.4% at the end of FY24. This trend signifies a clear outperformance of real estate prices compared to inflation.

|

Year |

Inflation Rate (%) |

Residential Price (INR/sq ft) |

|

FY24 |

5.40% |

7,550 |

|

FY23 |

6.70% |

6,325 |

|

FY22 |

5.50% |

5,881 |

|

FY21 |

6.20% |

5,660 |

|

FY20 |

4.80% |

5,599 |

|

FY19 |

3.40% |

5,573 |

|

FY18 |

3.60% |

5,519 |

|

FY17 |

4.50% |

5,474 |

|

FY16 |

4.91% |

5,465 |

|

FY15 |

5.90% |

5,300 |

Source: ANAROCK Research, RBI

With tangible real estate, in response to growing investor demand for inflation protection, financial instruments such as real estate investment trusts (REITs) and inflation-linked bonds have gained popularity. REITs, which invest in income-generating real estate, offer investors exposure to the real estate market coupled with liquidity and diversification benefits. Similarly, inflation-linked bonds adjust their principal and interest payments based on changes in inflation rates.