Author: Shihao Fu, Technology Analyst at IDTechEx

In recent years, the promise of the public transport revolution has been teased by autonomous buses and roboshuttles. These technologies promise to deliver significant cost reductions for operators and alleviate labor pressures. Over 50 autonomous bus and roboshuttle players once competed in this space. However, as the autonomous driving industry evolved during 2022-2024, the commercialization progress of autonomous buses and roboshuttles has been slow, falling short of industry expectations. IDTechEx has observed a yearly decline in the number of active companies from 2020 to 2024, and large-scale commercial testing has not been achieved. Roboshuttles need to overcome the uncertainties posed by dynamic routes and the performance challenges of navigating narrow urban streets. Testing in such areas, closer to residential zones, means these vehicles will be under greater public scrutiny. Buses face the challenge of maintaining relatively high speeds while ensuring the safety of dozens of passengers, which is crucial for gaining public trust.

Global progress and policy support for autonomous buses and roboshuttles

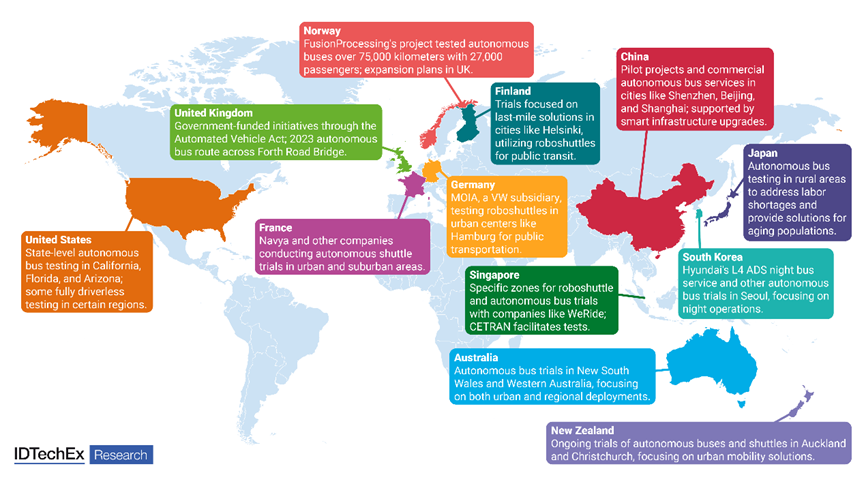

Despite the challenges, some companies have successfully navigated the complexities surrounding autonomous buses and roboshuttles, securing government permits for testing. Currently, these vehicles are undergoing near-commercialization testing in cities such as Singapore, France, China, and South Korea. In several areas, these tests involve real passengers and take place in controlled environments. The IDTechEx report, “Roboshuttles and Autonomous Buses 2024-2044: Technologies, Trends, Forecasts”, predicts that over the next decade, autonomous buses and roboshuttles will need to demonstrate their commercial viability to continue attracting investment and garner government backing for market development and policy endorsement.

Three pain points in the commercialization of Autonomous Trucks. Source: IDTechEx

China has implemented proactive policies supporting autonomous buses and roboshuttles. The government is driving the development of these technologies through pilot projects and significant infrastructure investments. Cities like Shenzhen, Beijing, and Shanghai have designated specific zones for autonomous bus testing. In fact, Shenzhen has already launched commercial autonomous bus services. Additionally, China is upgrading its smart infrastructure with technologies such as intelligent traffic signals and high-precision maps to facilitate the growth of autonomous driving.

In the U.S., autonomous vehicle regulations are primarily governed at the state level. States like California, Florida, and Arizona are at the forefront of autonomous bus and roboshuttle testing. These states have developed comprehensive legal frameworks that outline testing conditions, safety standards, and liability rules. For instance, California mandates that each autonomous vehicle must have a safety operator, while some states have progressed to allowing fully driverless testing. At the federal level, the National Highway Traffic Safety Administration (NHTSA) is working on nationwide standards to regulate autonomous vehicle technology.

Through the Automated Vehicle Act, the UK government is actively supporting the development of autonomous buses by providing a legal framework for testing and commercial deployment. For example, the autonomous bus route across the Forth Road Bridge that launched in 2023 is a testament to the practical application of this technology. Additionally, government-funded initiatives, such as those supported by Innovate UK, encourage businesses to participate in developing and validating these technologies.

Singapore is also a leader in testing autonomous vehicle technologies, adopting a steady and progressive approach. The Land Transport Authority (LTA) has designated specific zones for the testing of roboshuttles and autonomous buses, including collaborations with companies like WeRide. The CETRAN (Centre of Excellence for Testing and Research of Autonomous Vehicles) plays a pivotal role in facilitating these tests, with plans to scale up the use of autonomous technologies in public transport in the coming years.

Short-term commercial solutions for autonomous bus deployment

The autonomous bus industry is currently exploring two short-term commercial solutions:

- Replacing high-cost tram and light rail systems: Autonomous buses offer significant cost-saving potential, with infrastructure costs potentially reduced by 50%-80%. By eliminating the need for complex rail networks and replacing them with autonomous buses, cities can achieve a more flexible and cost-efficient public transport system.

- 24/7 autonomous operations in industrial parks: These environments are ideal for introducing continuous, driverless operations, integrated with automated charging solutions. Industrial parks benefit from controlled environments, allowing autonomous buses to operate without human intervention. This model reduces labor costs and increases operational efficiency, particularly for logistics and staff transport.

A strong example of this approach comes from FusionProcessing’s project in Norway, where autonomous buses have successfully covered 75,000 kilometers and transported 27,000 passengers. The success of this trial has boosted the credibility of their expansion plans with Stagecoach in the UK. Their long-term vision targets fully remote operations without onboard safety drivers by 2028, with staged transitions starting as early as 2025 in controlled environments like industrial logistics and segregated roads. However, despite the promising results, the key challenges that could affect this timeline include the need for regulatory approvals and the readiness of infrastructure, particularly for remote operations on public roads. Early results, nonetheless, indicate strong potential for these solutions to transform the public and industrial transportation sectors.

Over the next 10 years, the number of cities deploying roboshuttles is expected to increase by one or two per year, initially focusing on pilot zones similar to those in Singapore, with later integration into urban public transportation networks as a last-mile solution. Autonomous bus pilots will continue to be primarily government-supported projects, such as Hyundai's operation of nighttime autonomous shuttles in South Korea. However, on-demand autonomous services are growing rapidly, with robotaxi services already operating in regions of the US and China.

To find out more, please see IDTechEx’s report on the topic – “Roboshuttles and Autonomous Buses 2024-2044: Technologies, Trends, Forecasts”. Downloadable sample pages are available.