Author: Eve Pope, Technology Analyst at IDTechEx

In voluntary carbon markets, corporates or individuals set climate targets and voluntarily purchase carbon credits from environmental projects that can reduce or remove carbon dioxide emissions to reach them. Across IDTechEx’s research into point-source carbon capture, carbon dioxide removal, and carbon dioxide utilization, numerous business models for CCUS have been analyzed – including those based on voluntary market finance.

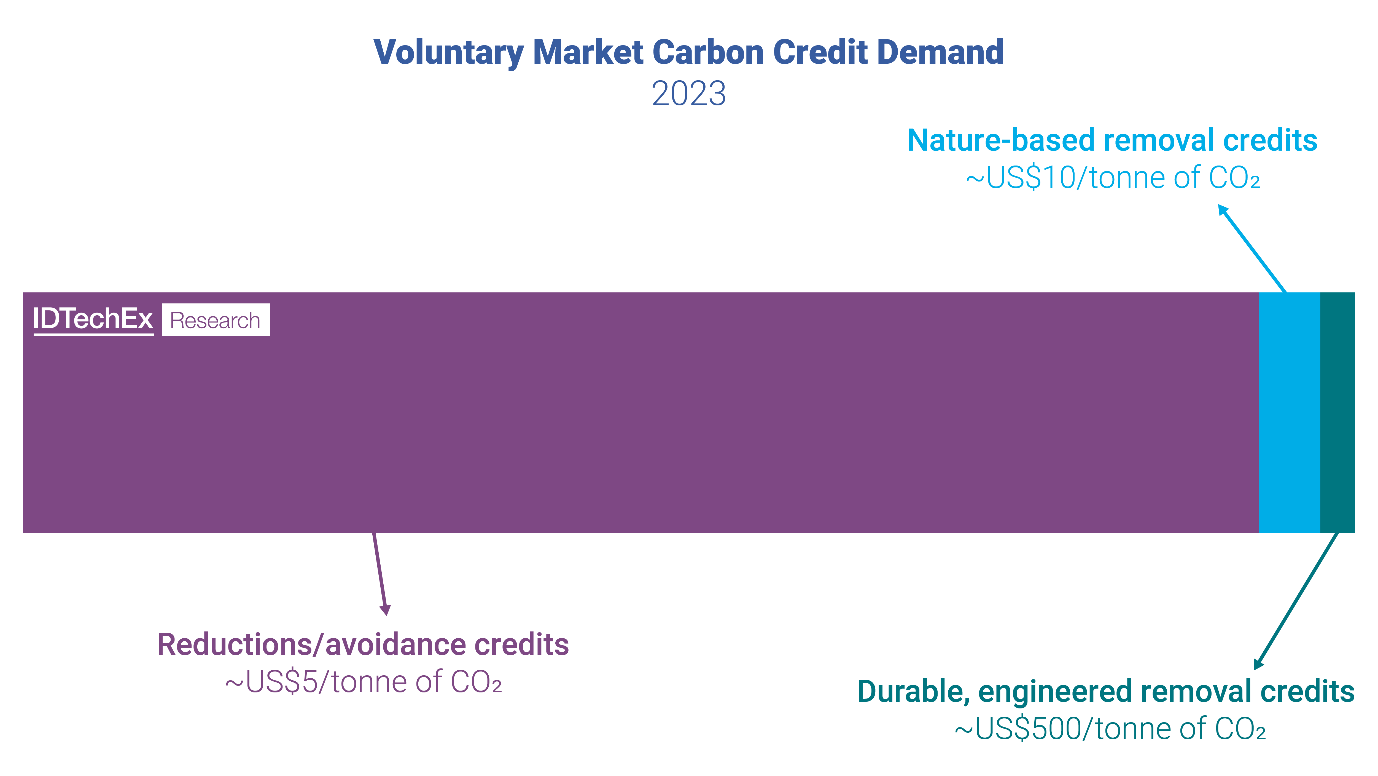

Carbon credit markets have weathered several scandals pertaining to poor-quality credits in recent years. The complex and sometimes volatile nature of these markets have led some to view the carbon credit space as “the wild west”. However, while most of the voluntary market saw a downturn in 2023, corners of the market selling durable, carbon removal credits are flourishing and playing a vital role in supporting emerging technologies such as direct air capture and CO2 utilization in concrete.

Which CCUS projects rely on voluntary market finance?

Most existing large-scale CCUS projects produce reductions in carbon dioxide emissions by preventing CO2 originating from fossil fuels from entering the atmosphere. Financial viability is achieved through CO2 utilization (usually enhanced oil recovery), government subsidies, or compliance carbon schemes (carbon taxes and emissions trading schemes) instead of relying on voluntary markets. Because double counting is prohibited for carbon credits, most CCUS projects would be ineligible for voluntary market carbon credit issuance because the emitter or national government has already claimed the associated environmental impact. Carbon reduction credits are generated from projects such as clean cookstoves and avoided deforestation instead of CCUS.

But the picture is very different for durable, engineered carbon credits – such as those generated from CO2 is captured and permanently sequestered directly from the atmosphere (DAC – direct air capture) or the biosphere (BECCS – bioenergy with carbon capture and storage). Because of the highly verifiable climate impact and lack of reversibility, corporations are willing to pay top prices for high-quality climate action and the positive press from fostering these nascent technologies. Demand outstrips supply for these lucrative credits, with most sales taking the form of pre-purchase agreements. Durable carbon removal credits sold for hundreds of dollars per tonne of CO2, and 2023 was a breakout year for sales (although sales in 2024 have already surpassed this record).

Voluntary market carbon credit demand in 2023. Reduction credits from technologies such as clean cookstoves, renewables, and avoided deforestation dominated volume, but durable, removal credits were more valuable. Source: IDTechEx

Direct air capture

Direct air capture is expensive. CO2 levels in the atmosphere are low, demanding large amounts of energy for CO2 separation. Currently, compliance market support for direct air capture is severely lacking. Even in regions where governmental financial support is available, such as the US 45Q tax credit scheme, the money on offer falls below the cost of capturing and storing carbon dioxide. The success of DAC companies has, therefore, largely been driven by voluntary market support via carbon credit purchases.

For example, in July 2024, Microsoft agreed to purchase 500,000 tonnes of removal credits from Occidental’s 1PointFive Stratos direct air capture facility. When Stratos opens in 2025, it will become the largest DAC facility in the world (removing 0.5 million tonnes per year of CO2 directly from the atmosphere). At such a large scale, the economics of DAC are expected to improve. Profitable demonstration will be essential to the future of the technology.

CO2-derived concrete

For many CO2 utilization applications, the volume of CO2 recycled is small, limiting revenue generation potential from voluntary carbon credit sales. However, some utilization applications also permanently sequester carbon dioxide – such as stable carbonate formation in the production of CO2-derived concrete. When using biogenic sources of carbon dioxide, such as from biogas or ethanol production, making CO2-derived concrete corresponds to removing carbon dioxide from the biosphere and enables lucrative carbon credit generation.

Most CO2-derived concrete players currently sell carbon credits on the voluntary market to generate additional revenue (or intend to in the future.) By combining this revenue generation with product sales and waste disposal fees, some CO2-derived concrete players are already reporting profitability.

Outlook

Voluntary demand is vulnerable and prone to volatility. While voluntary market carbon credits are expected to keep supporting emerging CCUS technologies in the short term – such as direct air capture technologies or carbon dioxide utilization in concrete – incorporation into compliance market carbon pricing schemes will be needed to reach a climate impactful scale. Although the timeline remains uncertain, continued Article 6 negotiations and the introduction of the EU’s Carbon Removal Certification Framework show positive progress towards this goal.

More information

For information on:

- The entire CCUS value chain, see the IDTechEx report “Carbon Capture, Utilization, and Storage (CCUS) Markets 2025-2045: Technologies, Market Forecasts, and Players“

- Direct air capture, see the IDTechEx report “Carbon Dioxide Removal (CDR) 2024-2044: Technologies, Players, Carbon Credit Markets, and Forecasts“

- CO2 utilization, see the IDTechEx report “Carbon Dioxide Utilization 2025-2045: Technologies, Market Forecasts, and Players“

For the full portfolio of energy and decarbonization market research available from IDTechEx, please see www.IDTechEx.com/Research/Energy.