Author: Dr Shababa Selim, Senior Technology Analyst at IDTechEx

Historically, aerogels have experienced steady market growth. However, in recent years, applications as a fire protection material for electric vehicle (EV) batteries have provided a new and rapidly growing market for aerogels. For example, according to IDTechEx’s report, “Aerogels 2025-2035: Technology, Market, Forecasts”, the demand for aerogels for EV fire protection grew by 15-fold between 2021 and 2024, with growth expected to continue. To meet growing demands, aerogel manufacturers are investing to ramp up capacity, in some cases pivoting towards using external manufacturers in China. However, with the US imposing tariffs on China and an increasingly uncertain global trade landscape, where does this leave the aerogels market?

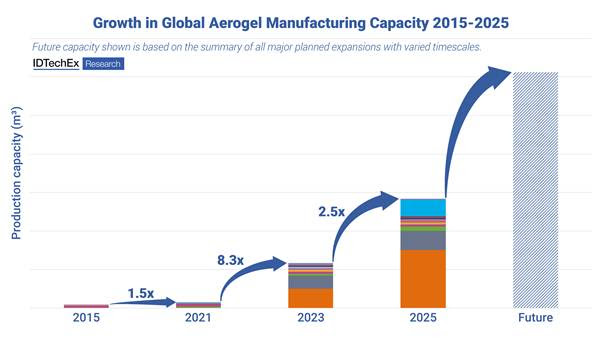

Significant Growth in Global Aerogel Production Capacity is Expected, Driven by Chinese Manufacturers. Source: IDTechEx

Challenges facing manufacturers to increase capacity

Several players have ongoing efforts to increase manufacturing capacity, which requires sizeable capital expenditure (CapEx). Following an incident at Armacell’s manufacturing facility in South Korea in 2024, which caused significant disruption to the supply of its ArmaGel range, Armacell announced that it is accelerating the launch of its plant in Pune, India, with a capacity of 1 million m2/year, expected to come online around mid-2025.

However, market uncertainties surrounding electric vehicle sales in the US in the near term add challenges for aerogel manufacturers to justify investing hundreds of millions of dollars to boost in-house production capacity and will likely encourage players to take a more cautious approach. A particular example of this is Aspen Aerogels, which had been in the process of establishing its second manufacturing base, ‘Plant II’, in Bulloch County, which was expected to come online in 2027, having secured loans from the US DoE amounting to US$670.6 million. However, in February 2025, Aspen announced that it would no longer progress with ‘Plant II’ and would instead expand the capacity of its existing plant and rely substantially on its external manufacturer based in China to meet long-term demand.

Players navigating challenges amid tariffs and China’s dominance in aerogel manufacturing

China’s dominance in aerogel manufacturing has significantly increased. Numerous players have established sizeable production capacities over the past few years, such as IBIH, Nano Tech, Jiangxi Chenguang New Materials, Namate New Materials, among many others. According to IDTechEx estimates, China currently accounts for approximately 97% of the global aerogel production capacity, with several major expansions planned. Details of key planned expansions and analysis are available within IDTechEx’s “Aerogels 2025-2035: Technology, Market, Forecasts” report.

Aspen Aerogels is already leveraging the expanding production capacity of Chinese manufacturers for its Energy Industrial business, with additional capacity expected to come online as early as 2026 for its EV sector. Using an external manufacturing partner in China allows the company to reduce capex and take a low-risk, flexible approach to expansion while capitalizing on expedited timescales of production ramp-up available in China. Similarly, Armacell is also using production capacity in China to meet demands in the interim while it establishes its manufacturing plant in India.

However, the uncertain tariff landscape and geopolitical tensions present challenges that players have to navigate in the global aerogel market. For example, Aspen Aerogels announced in its investor call in February 2025 that it is looking at tackling tariff risks through pricing strategies, optimizing sourcing, and working with its Chinese contract manufacturer to lower production costs. Moreover, the volatile nature of tariffs in today’s markets introduces challenges for businesses to implement significant structural changes to their business models that can have long-term implications.

IDTechEx outlook

IDTechEx has been studying the aerogel industry for many years, with technical experts conducting an extensive number of primary interviews to bring the reader a granular and detailed assessment of this industry.

Globally, there has been a significant growth in aerogel manufacturing capacity in the last 5 years, with China dominating production capacity. IDTechEx has evaluated the planned expansions from major players, the summary of which suggests a substantial expansion of existing production capacity will continue in the future, subject to market performance. A growing supply of aerogels will be essential to meet the demand for aerogels across applications such as EV batteries, industry, LNG & energy, and more, and players have been increasingly looking to China to grow capacity at a lower capex. However, with aerogels already considered a premium insulation product, a volatile tariff landscape and the implications on pricing may introduce further barriers to the aerogel market, particularly in the US.

IDTechEx’s “Aerogels 2025-2035: Technology, Market, Forecasts” report includes a comprehensive assessment and analysis of key aerogel manufacturers such as Aspen Aerogels, Cabot, IBIH, Nano Tech, Armacell, LG Chem, and several others, covering products, production processes, production capacity, planned expansions, and more.

The report offers a comprehensive and independent analysis of the global aerogel market, giving detailed ten-year market forecasts segmented by application and material type. The materials covered include polymer, silica, and silica composite blankets, pads, sheets, foams, and a range of other form factors. The report also benchmarks commercially available aerogels across several applications, including thermal barriers for EV batteries, oil & gas, building & construction, and several others. Assessment of aerogel applications is also included for other markets such as energy storage, electronic appliances, daylighting & windows, and many more.

To find out more about IDTechEx’s “Aerogels 2025-2035: Technology, Market, Forecasts” report, including downloadable sample pages, please visit www.IDTechEx.com/Aerogel.

For the full portfolio of advanced materials and critical minerals market research available from IDTechEx, please see www.IDTechEx.com/Research/AM.