|

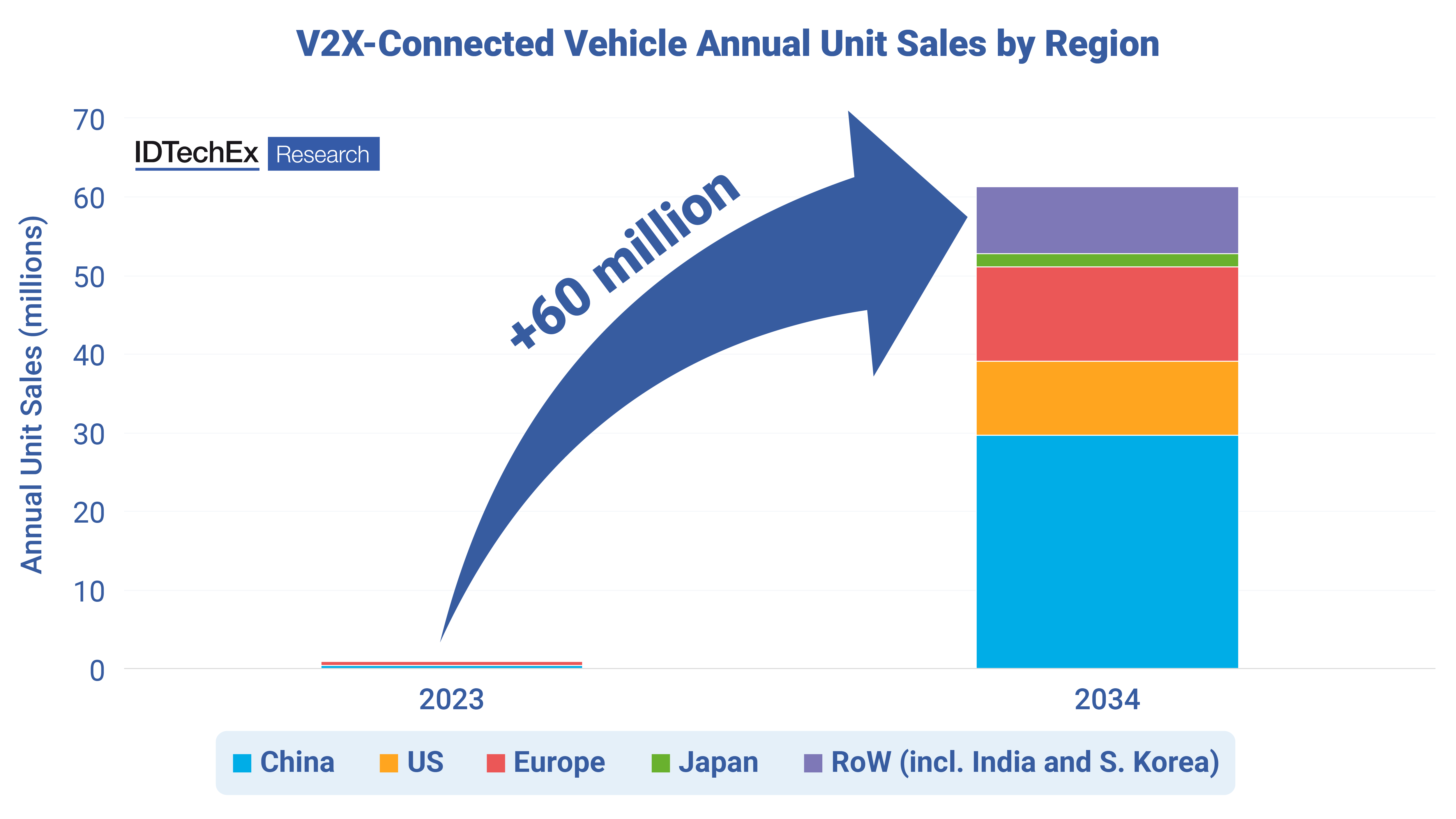

Author: James Falkiner, Technology Analyst at IDTechEx China is set to add 30 million new V2X-enabled vehicles to the road every year by 2034, according to IDTechEx’s report, “Connected and Software-Defined Vehicles 2024-2034: Markets, Forecasts, Technologies”, as part of a wider global trend that will see V2X technology become the standard in most vehicles. The future connected vehicle does not just use a standard smartphone cellular connection but also takes advantage of dedicated ‘V2X’ safety communication channels. V2X, which stands for Vehicle-to-Everything, uses either Wi-Fi or cellular-based technology to facilitate communication with other vehicles and traffic infrastructure. If regulation or safety standards mandate this technology, then V2X is set to become the ‘digital seatbelt’ of the future, promising to reduce accidents, improve congestion, and reduce emissions globally by allowing vehicle safety systems to talk to each other and to city traffic infrastructure, even in the pouring rain, dense fog, or busy carparks.

|

||

|

Annual V2X-Connected Vehicle Unit Sales are expected to exceed 60 million units by 2034. Source: IDTechEx |

||

|

The two most popular technologies for V2X, DSRC, and C-V2X, both require different hardware. DSRC is based on Wi-Fi protocols, and C-V2X is based on 4G or 5G protocols. Currently, there are approximately 1 million V2X-connected vehicles on the road globally, with those mainly concentrated in Europe and China. About half the market is using DSRC-based technology (The Volkswagen Golf 8 and ID.X vehicles are equipped with ITS-G5 (EU DSRC equivalent) in Europe, known as Car2X), and the other half of the market is using C-V2X technology, with most of these vehicles being available in China. IDTechEx is forecasting a significant market shift towards C-V2X technology, with over 90% of the market forecasted to be using 5G-based C-V2X technology by 2034. The biggest contribution to this shift is regulation – the two largest vehicle markets in the world, the US and China, both have governmental organizations actively pushing for C-V2X adoption and have formally abandoned DSRC technology. India, Korea, and Japan are all likely to follow international trends set by the US and China. The EU is a region that is officially technologically neutral but has a strong existing DSRC/ITS-G5 base. The EU will likely maintain technology neutrality, and some C-V2X module providers are offering ‘Dual RAT’ systems that support both C-V2X and Wi-Fi-based V2X technology, meaning DSRC will maintain some market share globally. DSRC+, based on newer Wi-Fi technologies, may impact the market, but IDTechEx’s analysis concludes that technology improvements may be too little, too late, and DSRC is a technology that has much less momentum compared to C-V2X. If a technology is included in a New Car Assessment Program (NCAP), OEMs aiming to achieve a high safety rating must include it in order to pass certain tests. China has announced V2X inclusion in the CNCAP from 2024 onwards, which is set to result in significant growth for the technology in China. Many manufacturers target a 5-star score in NCAPs, as NCAP scores can significantly impact sales. As has been seen in the past with other safety technologies, such as automatic emergency braking (AEB), inclusion in a national NCAP assessment can be a significant driver for the adoption of a new safety technology. For example, AEB grew from being included in 5% of new vehicles in 2014 (before being included in the EU NCAP) to being included in 71% of new vehicles in 2021 (seven years after being included in the EU NCAP), according to IDTechEx's research. Some OEMs, especially OEMs targeting a lower price point, may not prioritize NCAP safety scores, though certain safety technologies, such as V2X communication, may still be included on vehicles if the OEM believes the technology will be a significant driver of vehicle sales. Some regional regulators could potentially mandate V2X technology in all new vehicles. One area where V2X could make the largest impact is for autonomous vehicles (AVs). The number and sophistication of sensors in an autonomous vehicle are vast and increase with the level of autonomy. AVs like those in Phoenix or San Francisco currently depend on LiDAR, radar, and cameras for the majority of their perception. Each sensor fulfills important functions and ensures robust and safe operation, but these vehicle sensor systems are limited by line-of-sight. Using either DSRC or C-V2X, autonomous vehicles can transmit information at a dedicated frequency (~5.9GHz), with V2X acting as an extra sensor that works in all weather conditions and can go through walls and obstacles, effectively solving the line-of-sight problem. The main feasible method for achieving this is to use V2X to broadcast the location-related information of each car. A connected vehicle receiving the information can calculate the possibility of collision with the other vehicle using onboard compute. If the risk is high, the driver (or passenger of an autonomous vehicle) will be immediately warned, and the system will adjust accordingly to avoid a collision safely and effectively. IDTechEx expects V2X connectivity to not become a major factor for autonomous vehicles before 2026. The technology could become mandatory for AVs within certain regions for regulatory reasons, or safety standards such as NCAP may integrate V2X into their testing of advanced driving assistance systems (ADAS), which would also apply to autonomous vehicles. To find out more about the IDTechEx report “Connected and Software-Defined Vehicles 2024-2034: Markets, Forecasts, Technologies”, including downloadable sample pages, please visit www.IDTechEx.com/CSDV. IDTechEx's market research portfolio includes reports on Connected and Software-Defined Vehicles, Future Automotive Technologies, and Autonomous Vehicles. These reports take a deep dive into the market drivers, barriers, technologies, players, and markets for the future of the automotive market. Comprehensive benchmarking is provided along with granular market forecasts. Sample pages are available to download for all IDTechEx reports. |